SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No.)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box: | | | | | |

Filed by the Registrant ☒

|

Filed by a Party other than the Registrant ☐

|

Check the appropriate box:

|

☐

o | Preliminary Proxy Statement |

☐

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)14a-6(e)(2)) |

☒

x | Definitive Proxy Statement |

☐

o | Definitive Additional Materials |

☐

o | Soliciting Material under §240.14a‑12 §240.14a-12 |

| | |

|

Everi Holdings Inc. |

(Name of Registrant as Specified Inin Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | |

| x | No fee required |

Payment of Filing Fee (Check the appropriate box):

|

☒

o | No fee required.

|

☐

| Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0-11.

|

| (1)

| Title of each class of securities to which transaction applies:

|

| | |

| (2)

| Aggregate number of securities to which transaction applies:

|

| | |

| (3)

| Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | |

| (4)

| Proposed maximum aggregate value of transaction:

|

| | |

| (5)

| Total fee paid:

|

| | |

☐

| Fee paid previously with preliminary materials. materials |

☐

o | Check box if any partFee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

To Our Stockholders: | | | | | | | | | | | |

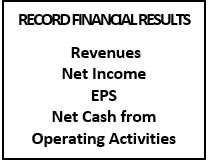

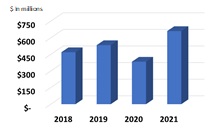

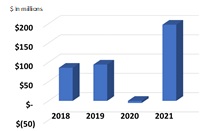

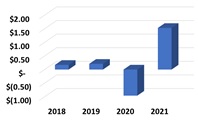

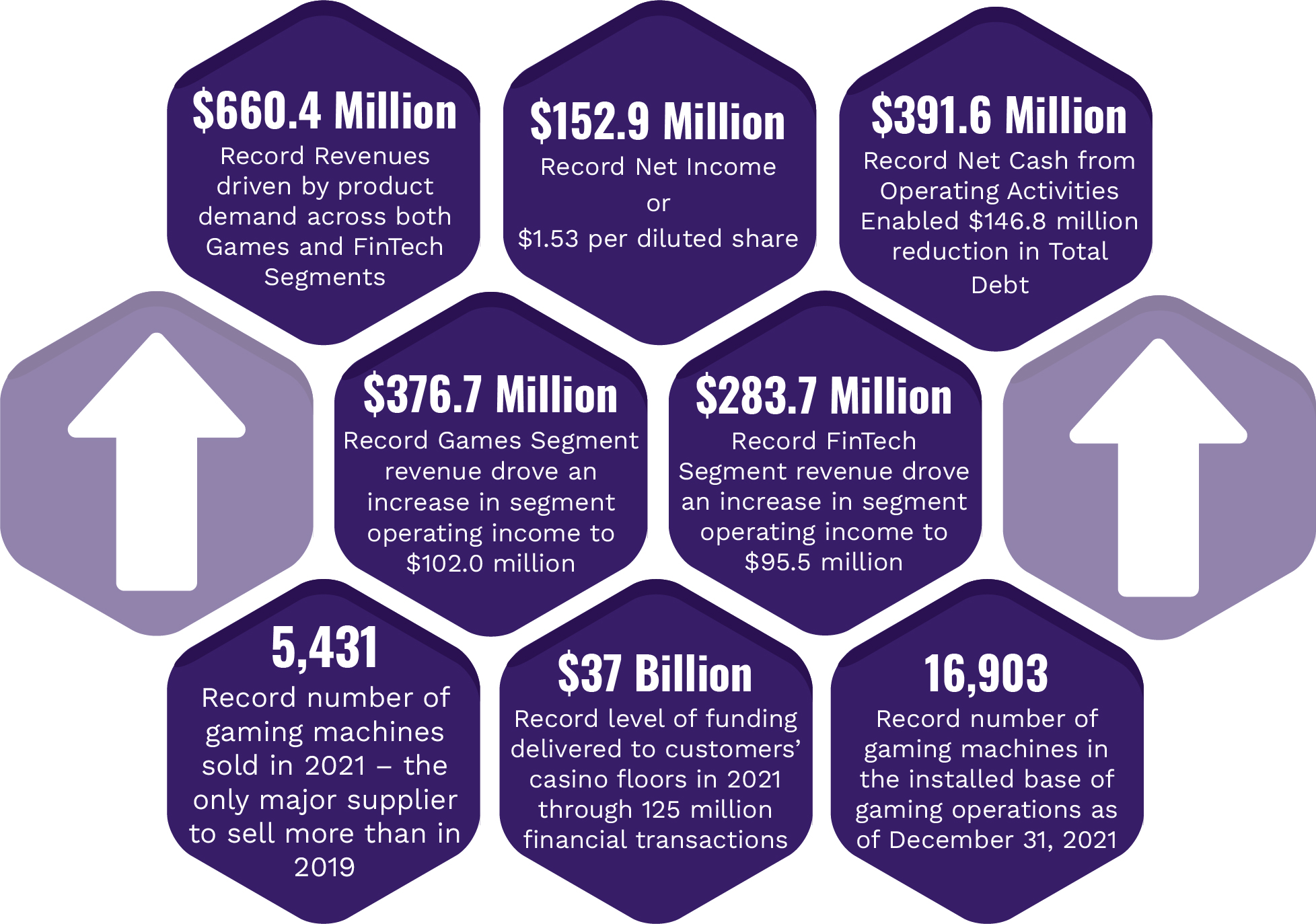

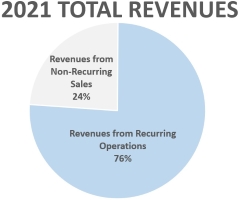

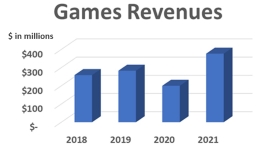

By nearly every measure, Everi had its best year ever in 2021. All-time financial records were set for revenues, net income, fully diluted earnings per share and net cash provided by operating activities; and both our Games and FinTech segments achieved record operating results. “Record Financial Results” This outstanding performance was accomplished in spite of the feeheadwinds that began 2021 with still substantial pandemic-related impact; and was in-line with the strong growth trends that had been achieved prior to the onset of the COVID-19 pandemic. From the record cash flow that accompanied our strong growth, we reinvested a portion to support investments aimed at sustaining future growth, while also paying down $147 million of total debt to significantly reduce Everi’s financial leverage and improve the Company’s credit ratings. Our outstanding results were achieved through the collaborative, well-aligned efforts of our workforce. The strength of our organization – the exceptional talent and diversity across our Company – has never been greater; and we cannot be prouder of our team. It is offset as providedimmensely gratifying to see people rise to tackle new challenges and make significant contributions. We would like to thank each and every one of our employees around the globe for living our core values everyday – Collaboration, Integrity, Inclusion, Excellence – and to do it while having Fun. Everi’s growth strategies include a priority on building and sustaining our high-return, recurring revenue operations. In 2021, these recurring revenue streams generated $503 million of revenue, representing approximately 76% of our total revenue, and grew 65% over 2020. It is our focus on growing these recurring revenue streams and consistent execution that are distinguishing elements of Everi. Within our Games segment, our success is powered by Exchange Act Rule 0-11(a)(2)the investments we have made to build world-class game development studios and identifyengineer a portfolio of differentiated gaming cabinets and games. The successes achieved in innovating new player-appealing games are driving share gains and growth in both gaming operations and our ship share of gaming machines sold. “Everi Named ‘Most Improved Supplier in Core Games Category 2021’ by EKG Gaming at Annual Slot Awards” In 2021, our Games business generated a record $376.7 million in revenues, an increase of 88% over 2020. We sold 5,431 gaming machines, an all-time high, and our installed base in gaming operations reached a record level of nearly 17,000 units. The success and player-popularity of our games also contributed to the filingrapid growth achieved in our Digital Gaming business, which is focused on providing our digital gaming content to online iGaming operators. Investments in our FinTech segment are focused on leveraging our strength in our core financial access services to build a digital neighborhood of integrated products and services, the equivalent of a “Digital Neural Network” for casinos that improves the cost efficiencies of their gaming operations. Using this digital network foundation, we can introduce new products and enhanced features to our customers, each of which adds further value for casino operators and strengthens our customer relationship, which in turn expands our addressable market for future growth. In 2021, our FinTech business generated a record $283.7 million in revenues, an increase of 55% over the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the dateprior year. Contributing to this record revenue were financial access services operations that facilitated nearly 125 million financial transactions that delivered $37 billion of its filing.funds to our customers’ casino floors.

“125 Million Financial Transactions Facilitated that Delivered $37 Billion of Funds to Customers’ Casino Floors” | | |

| (1)

| Amount Previously Paid:

|

| | |

| (2)

| Form, Schedule or Registration Statement No.:

|

| | |

| (3)

| Filing Party:

|

| | |

| (4)

|

| Date Filed:

| | | | | | | | | | |

Growth was also powered by our Software and Other revenues, which contributed $67.8 million compared to just $47.5 million in pre-pandemic affected 2019. These revenues largely comprise our Loyalty and RegTech compliance solutions together with our hardware maintenance services. A significant portion of the growth was due to our entry in 2019 into the Player Loyalty category of products. Just since 2019, our success in scaling this business resulted in a 35% expansion of our customer base for these products. Our long-term growth strategies also emphasize continuing to develop the diversity and strength of our workforce and organizational structure. Building a culture of diversity, collaboration and inclusion is a journey that needs steady nurturing. In 2021, our efforts were recognized by being named a top employer based on positive employee feedback gathered through an independent employee engagement survey. To maintain our progress, our efforts included hiring a Senior Vice President for Diversity, Inclusion and Talent Management and creating a task force led by our Chief Executive Officer (“CEO”) and our General Counsel to bring more consistent focus on improving efforts devoted to ESG (Environmental, Social and Governance) activities. This focus on employees and customers also extends to helping support the communities in which we live and work. Several years ago, we developed and launched an innovative, award-winning Everi Cares Giving Module® product for use with our financial access kiosks that allows casino patrons to donate the change from redeemed gaming vouchers and promotes corporate social responsibility. In conjunction with our customers, casino patrons, and employees, Everi has helped raise and donate more than $5 million to support charitable organizations. Our solid operating execution and focus on growth led to an unprecedented $391.6 million of net operating cash flow in 2021. We used a portion of this cash flow to reinvest in our business to support future growth, as well as to reduce our total debt, thereby reducing our financial leverage and putting the Company on a much more secure financial foundation. We expect to continue to generate strong cash flow in coming years, which we intend to invest to both support internal new product development and evaluate attractive growth acquisitions that will expand our addressable markets. “Focused on Growth and Building Shareholder Value” We believe our strong cash flows, growth strategies, and smart investments will continue to build long-term sustainable shareholder value. We thank you for your support as stockholders.

/s/ Michael D. Rumbolz /s/ Randy L. Taylor Michael D. Rumbolz Randy L. Taylor Executive Chairman of the Board Chief Executive Officer | | | |

|

| |

| |

| |

| |

| |

| | | | | |

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * During the year, we also announced a succession plan within our Board and management. I was appointed Executive Chairman of the Board and Randy Taylor has succeeded me as Chief Executive Officer. Randy also joined our Board effective April 1, 2022. Consequently, this will be my last Stockholder letter to you as Chief Executive Officer. It has been an honor and privilege to lead Everi these past six years. It has been an incredible journey of great achievements and growth, while also facing some of the toughest challenges of my business career. The Board also named Atul Bali as our Lead Independent Director to succeed Ron Congemi who will be retiring from the Board effective at our Annual Meeting of Stockholders on May 18, 2022. Ron has served on the Board since 2013, and we thank him for his many years of distinguished service. More recently, we announced the addition to our Board of Secil Tabli Watson, formerly Executive Vice President and Head of Digital Solutions at Wells Fargo, and Paul Finch, formerly Chief Executive Officer of Early Warning Services, which helped launch the banking industry’s first real-time payments network Zelle®. Both Secil and Paul are excellent additions to our Board, as each brings extensive business knowledge and leadership experience.

/s/ Michael D. Rumbolz

Michael D. Rumbolz Executive Chairman of the Board

April 19, 2022 | |

April 19, 2022

Dear Stockholder:

On behalf of Contents

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

To the holders of Common StockDirectors and officers of Everi Holdings Inc.:

The 2016 (“we,” “us,” “our,” “Everi,” or the “Company”), we are pleased to invite you to attend our 2022 Annual Meeting of Stockholders. The meeting will be held at Everi’s headquarters located at 7250 South Tenaya Way, Suite 100, Las Vegas, Nevada 89113, on Wednesday, May 18, 2022 at 9:00 a.m. Pacific Time (the “Annual Meeting”).

Due to the ongoing public health impact of the coronavirus disease 2019 (“COVID-19”) global pandemic, and in consideration of the health and well-being of our stockholders and other meeting participants, we will require attendees to comply with health and safety protocols endorsed by the Centers for Disease Control and Prevention.

At the Annual Meeting, you will be asked to:

| | | | | | | | | | | | | | | | | | | | |

| 1 | | 2 | | 3 | | 4 |

| Elect two Class II director nominees named in this Proxy Statement. | | Approve, on a non-binding, advisory basis, the compensation of our named executive officers. | | Ratify the appointment of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022. | | Transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. |

The accompanying Proxy Statement provides a detailed description of these proposals and other information that you should read and consider before voting.

Your vote is very important to us. Regardless of whether you expect to attend the Annual Meeting in person, please submit your proxy or voting instructions over the Internet, telephone, or by mail as soon as possible to ensure that your shares are represented at the Annual Meeting and your vote is properly recorded. If you decide to attend the Annual Meeting, you will be able to vote in person, even if you previously submitted your proxy.

If you have any questions concerning the Annual Meeting, and you are the stockholder of record of your shares, please contact our Senior Vice President, Investor Relations, William Pfund, at william.pfund@everi.com or (702) 676-9513. If your shares are held by a broker or other nominee, please contact your broker or other nominee for questions concerning the Annual Meeting.

Your Board brings executive, financial, and strategic leadership together with a wide range of complementary skills and backgrounds relative to the Company’s industry, to assist management in continuing to drive success. The Board remains diligent and highly focused on our people, sustainable growth, and performance as we continue to build long-term shareholder value and continue striving for a more diverse and inclusive Company. On behalf of the Board of Directors and our employees, we thank you for your past and ongoing support of the Company.

Sincerely,

/s/ Randy L. Taylor

Randy L. Taylor

Chief Executive Officer & Director

| | | | | |

| NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS |

Date and Time: Wednesday, May 18, 2022 9:00 a.m. Pacific Time | Location: Everi Holdings Inc. Corporate Headquarters 7250 South Tenaya Way, Suite 100 Las Vegas, Nevada 89113 |

To Our Stockholders:

You are cordially invited to attend the 2022 Annual Meeting of Stockholders

(the “Annual Meeting”) of Everi Holdings Inc.,

formerly known as Global Cash Access Holdings, Inc. (the “Company”),at which stockholders will

be held as follows:When:9:00 a.m., local time, Monday, May 23, 2016

Where:Everi Corporate Headquarters

7250 S. Tenaya Way, Suite 100

Las Vegas, Nevada 89113

The purposevote on the following proposals listed below. Your vote is very important to us. Regardless of whether you expect to attend the Annual Meeting isin person, please submit your proxy or voting instructions over the Internet, telephone, or by mail as soon as possible to consider and take action on the following proposals:

1.The election of three Class II directors;

2.The approval, on an advisory basis, of the compensation of our named executive officers as shown in this proxy statement;

3.The ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm;

4.A non-binding stockholder proposal as described in this proxy statement, if properly presented at the Annual Meeting; and

5.To transact such other business as may properly be brought before the Annual Meeting or any adjournment or postponement thereof.

Holders of record of Everi Holdings Inc. common stock at the close of business on April 8, 2016ensure that your shares are entitled to notice of and to voterepresented at the Annual Meeting or any adjournment or postponement thereof.

YOUR PROXY IS IMPORTANT TO ASSURE A QUORUM AT THE ANNUAL MEETING. You are urgently requestedand your vote is properly recorded. If you decide to submitattend the enclosed proxy by telephone or through the Internet in accordance with the instructions provided to you. You may also date, sign and mail the Proxy Card in the postage‑paid envelope that is provided. Your proxy is revocable in accordance with the procedures set forth in the accompanying proxy statement.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be held on May 23, 2016. Our Proxy Statement is attached. Financial and other information concerning Everi Holdings Inc. is contained in our Annual Report to Stockholders for the fiscal year ended December 31, 2015. A complete set of proxy materials relating to our Annual Meeting, is available onyou will be able to vote in person, even if you previously submitted your proxy. The Company may require attendees to comply with health and safety protocols endorsed by the Internet. These materials, consisting of the Notice of Annual Meeting of Stockholders, Proxy Statement, Proxy CardCenters for Disease Control and Annual Report to Stockholders are available and may be viewed at www.proxyvote.com.

Prevention. | | | | | | | | | | | |

| By Order of the Board of Directors,

Voting Matters |

| 1. | |

| /s/ Michael D. Rumbolz

|

| |

| Michael D. Rumbolz

Interim President and Chief Executive Officer

|

| April 22, 2016

|

2016 PROXY STATEMENT TABLE OF CONTENTS

PROXY STATEMENT SUMMARY

This proxy statement is being issued in connection with the solicitation of proxies by the Board of Directors of Everi Holdings Inc. for use at the 2016 Annual Meeting of Stockholders and at any adjournment or postponement thereof. On, or about, April 25, 2016, we will begin distributing to each stockholder entitled to vote at the meeting this proxy statement, a proxy card or voting instruction form and our 2015 annual report. Shares represented by a properly executed proxy will be voted in accordance with instructions provided by the stockholder. This summary highlights information contained elsewhere in this proxy statement. It does not contain all of the information you should consider. You should read the entire proxy statement before casting your vote.

General Information

| |

| |

Date and Time:

| Monday, May 23, 2016

|

| 9:00 a.m. Pacific Time

|

| |

Record Date:

| April 8, 2016

|

| |

Place:

| Everi Corporate Headquarters, 7250 S. Tenaya Way, Suite 100, Las Vegas, Nevada 89113

|

| |

Voting:

| |

| |

Stockholders of record as of April 8, 2016 may cast their votes in any of the following ways:

| | | | | | |

| |

| |

| |

|

Internet

| | Phone

| | Mail

| | In Person

|

Visit www.proxyvote.com.www.proxyvote.com. You will need the 16-digit number included in your proxy card voteror voting instruction form or notice.form. |

| 2. | To approve on a non-binding, advisory basis, the compensation of our named executive officers. | | Call 1-800-690-6903 or the number on your votervoting instruction form. You will need the 16-digit number included in your proxy card voteror voting instruction form or notice.form. |

| 3. | To ratify the appointment of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022. | | Send your completed and signed proxy card or votervoting instruction form to the address on your proxy card or votervoting instruction form. |

| 4. | To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. | | If you plan to attend the meeting in person, you will need to bring a government-issued picture ID and proof of ownership of Everi Holdings Inc. common stock as of the record date. The Company may require attendees to comply with health and safety protocols endorsed by the Centers for Disease Control and Prevention. |

Voting Matters and Board Recommendations

| | | | | | |

| | | | Board | | |

Item | | Description | | Recommendation | | Page (for more detail) |

1 | | Election of directors | | FOR | | 9 |

2 | | Approval, on an advisory basis, of named executive officer compensation | | FOR | | 23 |

3 | | Ratification of independent auditor | | FOR | | 48 |

4 | | Stockholder proposal regarding simple majority voting | | AGAINST | | 51 |

Director Nominees

| ·

| |

| Record Date |

| Stockholders of record as of the close of business on April 4, 2022 will be entitled to notice of, and to vote at, the Annual Meeting, or any adjournment or postponement thereof. |

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be Held on May 18, 2022. Our Proxy Statement is attached. Financial and other information concerning Everi Holdings Inc. is contained in our Annual Report to Stockholders for the fiscal year ended December 31, 2021 (the “2021 Annual Report”). A complete set of proxy materials relating to our Annual Meeting is available on the Internet. These materials, consisting of the Notice of 2022 Annual Meeting of Stockholders, Proxy Statement, Proxy Card, and 2021 Annual Report are available and may be viewed at www.proxyvote.com. |

This Notice of Annual Meeting and the accompanying Proxy Statement are first being made available to our stockholders on or about April 19, 2022.

By Order of the Board of Directors,

/s/ Kate C. Lowenhar-Fisher

Executive Vice President, Chief Legal Officer – General Counsel

and Corporate Secretary

April 19, 2022

| | | | | | | | | | | | | | | | | |

| PROXY STATEMENT TABLE OF CONTENTS |

| PROXY STATEMENT SUMMARY | | | | Severance Benefits | |

| 2021 Performance Highlights | | | | Compensation Committee Report | |

| Corporate Governance Highlights | | | | Members of the Compensation Committee | |

| Environmental Sustainability; Social Responsibility | | | | Compensation of Named Executive Officers | |

| PROXY STATEMENT | | | | 2021 Summary Compensation Table | |

PROPOSAL 1: ELECTION OF TWO CLASS II DIRECTORS | | | | Grants of Plan-Based Awards | |

| | Outstanding Equity Awards | |

| BOARD AND CORPORATE GOVERNANCE MATTERS | | | | 2021 Option Exercises and Stock Vested | |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | | | | Employment Contracts and Equity Agreements, Termination of Employment, and Change in Control Arrangements | |

| EXECUTIVE OFFICERS | | | |

PROPOSAL 2: ADVISORY (NON-BINDING) VOTE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS (SAY ON PAY) | | | | Pension Benefits and Nonqualified Deferred Compensation | |

| | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |

| EXECUTIVE COMPENSATION | | | |

| Compensation Discussion and Analysis | | | | EQUITY COMPENSATION PLAN INFORMATION | |

| I. EXECUTIVE SUMMARY | | | | PAY RATIO | |

| Leadership Transition | | | | | |

| Compensation Actions | | | | PROPOSAL 3: RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| II. COMPENSATION PHILOSOPHY AND OBJECTIVES | | | |

| Compensation Governance Practices | | | | REPORT OF THE AUDIT COMMITTEE | |

| Components of Our Compensation Program | | | | FREQUENTLY ASKED QUESTIONS | |

| 2021 Target Total Compensation | | | | SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | |

| 2021 Say on Pay Results | | | | OTHER MATTERS | |

| III. COMPENSATION DECISION MAKING PROCESS | | | | ANNUAL REPORT TO STOCKHOLDERS AND ANNUAL REPORT ON FORM 10-K | |

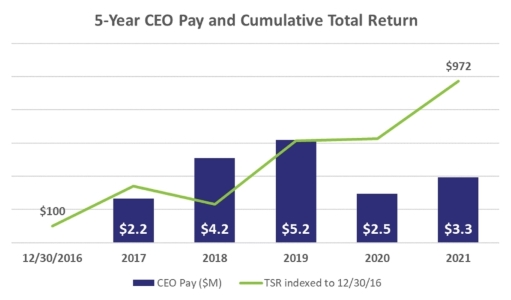

| Aligning Executive Compensation with Our Performance | | | |

| Role of the Board | | | | APPENDIX A: RECONCILIATION OF NON-GAAP MEASURES | |

| Role of the Compensation Committee | | | | |

|

| Role of Management | | | | | |

| Role of Compensation Consultants | | | | | |

| Compensation Risk Oversight | | | | | |

| IV. COMPENSATION COMPETITIVE ANALYSIS | | | | |

| Peer Group | | | | | |

| V. ELEMENTS OF COMPENSATION | | | | | |

| Base Salary Compensation | | | | | |

| Annual Incentives | | | | | |

| 2021 Performance Metrics | | | | | |

| 2021 Performance and Actual Payouts | | | | | |

| Long-Term Equity Incentive Awards | | | INDEX OF FREQUENTLY REQUESTED INFORMATION |

| 2021 Awards | | | Corporate Governance Highlights | |

| VI. ADDITIONAL COMPENSATION POLICIES AND PRACTICES | | | Environmental Sustainability; Social Responsibility | |

|

| Equity Ownership Policy | | | Director Nominees | |

| Clawback Policy | | | Compensation of Directors | |

| Anti-Hedging and Anti-Pledging Policies | | | Compensation of Named Executive Officers | |

| Tax Considerations | | | Pay Ratio | |

| Retirement Plans | | | | | |

| Two of our three nominees are independent

| |

| PROXY STATEMENT SUMMARY |

| ·

| | Two

| | | | | | | | | | | |

2022 Annual Meeting of our three nominees have servedStockholders |

| | | | |

DATE AND TIME Wednesday, May 18, 2022 9:00 a.m. Pacific Time

| |

LOCATION Everi Holdings Inc. Corporate Headquarters 7250 South Tenaya Way, Suite 100 Las Vegas, NV 89113

| |

RECORD DATE APRIL 4, 2022

|

| | | | | | | | | | | |

How to Vote

|

VIA THE INTERNET

Visit www.proxyvote.com. You will need the 16-digit number included in your proxy card or voting instruction form. | BY TELEPHONE

Call 1-800-690-6903 or the number on our Boardyour voting instruction form. You will need the 16-digit number included in your proxy card or voting instruction form. | BY MAIL

Send your completed and signed proxy card or voting instruction form to the address on your proxy card or voting instruction form. | ATTENDING THE MEETING

If you plan to attend the meeting in person, you will need to bring a government-issued picture ID and proof of Directorsownership of Everi Holdings Inc. common stock as of the record date. The Company may require attendees to comply with health and safety protocols endorsed by the Centers for less than seven yearsDisease Control and Prevention. |

| ·

| | All of our director nominees are highly-qualified individuals with diverse skills, backgrounds and experiences

|

| | | | | | | | | | | | | | | | | | | | |

| Annual Meeting Proposals |

| Proposal | | Description | | Board Recommendation | | Page (for more detail) |

| 1 | | Election of two Class II director nominees named in this Proxy Statement. | | þ FOR each of the Board’s nominees | | |

| 2 | | Approval, on an advisory basis, of the compensation of our named executive officers. | | þ FOR | | |

| 3 | | Ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022. | | þ FOR | | |

| | | | | | | | |

| | | | Director | | | | |

Name | | Age | | Since | | Principal (or Most Recent) Occupation | | Current Committees |

Geoff Judge | | 62 | | 2006 | | Partner at iNova Capital, a manager of early stage venture capital funds | | Audit; Compensation; Nominating and Corporate Governance |

Michael D. Rumbolz | | 62 | | 2010 | | Interim President and Chief Executive Officer of the Company; Former Chairman and Chief Executive Officer of Cash Systems, Inc.; Former Chairman of the Nevada Gaming Control Board | | None |

Ronald Congemi | | 69 | | 2013 | | Former Chief Executive Officer of First Data’s Debit Services Group; member of the Philadelphia Federal Reserve’s Payments Advisor Council; founder of Star Systems, Inc., an Automated Teller Machine (“ATM”) network | | Audit; Compensation; Nominating and Corporate Governance |

Governance and Compensation Highlights

| ·

| | All of our directors are independent (other than our Interim President and Chief Executive Officer)

|

Stockholders will also transact any other business that properly comes before the meeting. | ·

| | We have adopted “plurality-plus” voting for directors(i.e., a plurality vote standard coupled with a mandatory resignation policy for nominees who fail to achieve an affirmative majority of votes cast)

| | | | | | | | | | | |

| General |

| ·

| | Each of our Board committees is entirely independent

|

| ·

| | We separate the roles of Chairman and Chief Executive Officer

|

| ·

| | Our independent directors meet regularly in executive sessions without our Chief Executive Officer or other management present

|

| ·

| | Our directors may not serve on a total of more than three public company boards without the approval of the Nominating and Corporate Governance Committee

|

| ·

| | Our directors and officers are subject to stock ownership guidelines

|

| ·

| | We have adopted an incentive compensation clawback policy

|

| ·

| | We have adopted anti-hedging and anti-pledging policies

|

| ·

| | We seek to pay our executives based on performance

|

| ·

| | We have a Code of Business Conduct, Standards and Ethics and provide training to our employees on compliance

|

| ·

| | We do not have a stockholder rights (poison pill) plan

|

| ·

| | Our Board has established a formal process for executive succession planning

|

Stockholder Engagement

At the 2015 annual meeting of stockholders, our say-on-pay proposal received the support of approximately 51% of the shares voted. Our Board was concerned and disappointedThis Proxy Statement is being furnished in this outcome, and as a result, we undertook a broad-based stockholder outreach and engagement program to solicit feedback, understand investor concerns and consider any necessary and appropriate actions.

Over several months, our Compensation Committee and management reached out to the majority of top 20 shareholders, representing approximately 68.5% of our shareholders at the time, and had extensive, meaningful dialogue with stockholders representing approximately 42.5% of our outstanding Common Stock, as well as with two leading proxy advisory firms, Institutional Shareholder Services, Inc. and Glass Lewis & Co. Our stockholders were pleasedconnection with the proposed changes we were implementing, and asked questions and raised concerns about certain other practices. As a resultsolicitation of these conversations, we made additional changes that will strengthen our compensation program and further align management and stockholder interests. Our stockholders universally expressed a desire for ongoing communication, which we believe is prudent and valuable for all parties.

Although our stockholder base is diverse in type and size, and certainly in processes for compensation program evaluation, several topics were commonly raised, which included:

| | |

| | |

What We Heard

| | What We Did

|

| | |

Questions regarding Ram Chary’s 2014 pay

Issues included:

—Perceived weak link between pay and performance

—Single trigger provision

—Pure quantum concerns

|

| •Discussed challenging nature of disclosed vs. realized values forproxies by the options grants

•Discussed the switch in mid-year 2015 from single to double trigger equity acceleration provisions

•Introduced incentive clawbacks and stock ownership guidelines

•Conducted a competitive benchmarking study using industry best practice against which to make future pay decisions

|

Disclosure needs to improve

|

| •Worked diligently with our compensation consultant to make our Compensation Discussion and Analysis more transparent and meet investor expectations

|

Concerns regarding retention

|

| •We redesigned the long-term incentive plan for 2016 to incorporate a different mix of performance metrics to better encourage retention while still motivating our executives

|

| | |

| | |

| | |

2016 ANNUAL MEETING PROXY STATEMENT

QUESTIONS AND ANSWERS

Why am I receiving these proxy materials?

The Board of Directors (the “Board”) of Everi Holdings Inc., a Delaware corporation, formerly known as Global Cash Access Holdings, Inc. (the (“we,” “us,” “Everi,” or the “Company”), is furnishing these proxy materials to you in connection with the Company’s 2016 annual meeting of stockholders (the “Annual Meeting”). The Annual Meeting will be held on Monday, May 23, 2016, for use at the Company’s corporate offices located at 7250 S. Tenaya Way, Suite 100, Las Vegas, Nevada 89113 beginning at 9:00 a.m., local time. You are invited to attend the Annual Meeting and are entitled and requested to vote on the proposals outlined in this proxy statement (this “Proxy Statement”).

This Proxy Statement is dated April 22, 2016 and is first being mailed to stockholders on or about April 25, 2016.

What proposals will be voted on at the Annual Meeting and what are the recommendations of the Board?

There are four proposals scheduled to be voted on at the Annual Meeting. Those proposals, and the Board’s voting recommendations with respect to such proposals, are as follows:

| | | | |

Proposal

| | | | Board’s Voting Recommendations

|

1

| | The election of three Class II directors to serve until the 2019 annual meeting of stockholders and until such director’s respective successor has been duly elected and qualified or until his earlier resignation or removal.

| | For the Board’s nominees

|

2

| | The approval, on an advisory-non-binding basis, of the compensation of the Company’s named executive officers as disclosed in this Proxy Statement.

| | For

|

3

| | The ratification of the appointment of BDO USA, LLP as the Company’s independent registered public accounting firm -hereinafter referred to as “independent auditors” for the fiscal year ending December 31, 2016.

| | For

|

4

| | A non-binding stockholder proposal regarding simple majority voting

| | Against

|

Management does not know of any matters to be presented at the Annual Meeting other than those set forth in this Proxy Statement and in the Notice of2022 Annual Meeting of Stockholders accompanying this Proxy Statement. Without limiting our abilityand at any adjournment or postponement thereof. On or about April 19, 2022, we will begin distributing to apply the advance notice provisions in our Second Amended and Restated Bylaws with respect to the procedures that must be followed for a matter to be properly presented at an annual meeting, if other matters should properly come before the Annual Meeting, the proxy holders will vote on such matters in accordance with their best judgment. Our stockholders have no dissenter’s or appraisal rights in connection with any of the proposals to be presented at the Annual Meeting.

What is the record date and what does it mean?

The record date for the Annual Meeting is April 8, 2016. The record date was established by the Board as required by Delaware law. Only holders of shares of the Company’s common stock, par value $0.001 per share (“Common Stock”), at the close of business on the record date areeach stockholder entitled to receive notice of, and to vote at the 2022 Annual Meeting and any adjournments or postponements thereof. Atof Stockholders this Proxy Statement, the closeNotice of business on April 8, 2016, we had approximately 66,183,745 shares of Common Stock outstanding and entitled to vote.

Shares held in treasury by the Company are not treated as being issued or outstanding for purposes of determining the number of shares of Common Stock entitled to vote.

How many votes do I have?

Each holder of shares of Common Stock is entitled to one vote for each share of Common Stock owned as of the record date.

Who is a “stockholder of record” and who is a “beneficial holder”?

You are a stockholder of record if your shares of our Common Stock are registered directly in your own name with our transfer agent as of the record date. You are a beneficial owner if a bank, brokerage firm, trustee or other agent (called a “nominee”) holds your stock. This is often called ownership in “street name” because your name does not appear in the records of the transfer agent. If your shares are held in street name, you will receive instructions from the holder of record. You must follow the instructions of the holder of record in order for your shares to be voted. Internet voting also will be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you plan to vote your shares in person at the2022 Annual Meeting you should contact your broker or agent to obtainof Stockholders, a legal proxy or broker’s proxy card or voting instruction form, and bring it to theour 2021 Annual Meeting in order to vote.

Who votes shares held in “street name”?

If you are a beneficial owner of shares held in “street name” by a bank, brokerage firm, trustee or other holder of record, and you do not give that record holder specific instructions as to how to vote those shares, then under the rules of the New York Stock Exchange (the “NYSE”), your record holder may exercise discretionary authority to vote your shares on routine proposals, including Proposal 3 (the ratification of the Company’s independent auditors). Without your specific instructions, however, your record holder cannot vote your shares on non‑routine proposals, including the election of directors, the advisory vote on the compensation of our named executive officers and the non-binding stockholder proposal. Accordingly, if you do not instruct your record holder how to vote with respect to Proposal 1 (election of directors), Proposal 2 (advisory vote on executive compensation), and Proposal 4 (stockholder proposal regarding simple majority voting), no votes will be cast on your behalf with respect to such proposals (this is referred to as a “broker non‑vote”). Your record holder, however, will continue to have discretion to vote any uninstructed shares on Proposal 3 (the ratification of the Company’s independent auditors). If you hold your shares in street name, please refer to the information forwarded by your bank, broker or other holder of record for procedures on voting your shares or revoking or changing your proxy. We encourage you to provide instructions to your broker regarding the voting of your shares.

What constitutes a quorum?

The presence at the Annual Meeting, in person or by proxy, of a majority of the shares of Common Stock outstanding and entitled to vote on the record date will constitute a quorum permitting the proposals described herein to be acted upon at the Annual Meeting. Abstentions and broker non‑votes are counted as present and are, therefore, included for purposes of determining whether a quorum of shares of Common Stock is present at the Annual Meeting.

What is the voting requirement to approve each of the proposals?

| ·

| | Election of directors (Proposal 1). The affirmative vote of a plurality of the outstanding shares of Common Stock present in person, or by proxy, at the Annual Meeting and entitled to vote is required for the election to the Board of the nominees for a Class II director (meaning that the three director nominees who receive the highest number of shares voted “for” their election are elected). Stockholders do not have the right to cumulate their votes in the election of directors. Votes that are withheld and broker non-votes will have no effect on the outcome of the election; however, a director nominee receiving a specified amount of “withhold votes” will trigger the Company’s guideline regarding majority voting for directors.

|

The Company amended its Corporate Governance Guidelines effective July 1, 2015 to include a guideline regarding majority voting for directors. Under the majority voting guideline, if a nominee for director in an uncontested election of directors (i.e., an election other than one in which the number of director nominees exceeds the number of directorships subject to election), does not receive the vote of at least “the majority of the votes cast” at any meeting for the election of directors at which a quorum is present and no successor has been elected at such meeting, the director will promptly tender his or

her resignation to the Board. For purposes of this corporate governance guideline, “the majority of votes cast” means that the number of shares voted “for” a director’s election exceeds 50% of the number of votes cast with respect to that director’s election, and “votes cast with respect to that director’s election” includes votes to withhold authority, but excludes abstentions and broker non-votes (i.e., failures to vote with respect to that director’s election). If a nominee for director does not receive the majority of the votes cast in an uncontested election, then that director must promptly tender his or her resignation following certification of the stockholder vote. Thereafter, the Nominating and Corporate Governance Committee is required to make a recommendation to the Board on whether to accept or reject such resignation and whether any other actions should be taken. The Board is required to take action with respect to this recommendation within 90 days following certification of the stockholder vote and to promptly disclose its decision and decision-making process. Full details of the policy are set out in our Corporate Governance Guidelines, which are publicly available at the Corporate Governance section of the Investors page on our website at ir.everi.com/investor-relations/everi-overview.

| ·

| | Advisory vote on the compensation of our named executive officers (Proposal 2). The proposal to approve, on an advisory (non‑binding) basis, the compensation of our named executive officers requires the affirmative vote of a majority of the outstanding shares of Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote. Broker non‑votes will have no effect on the outcome of this proposal, while abstentions will have the effect of a vote against this proposal. Although this vote is advisory and non-binding on our Board, the Board and the Compensation Committee will consider the voting results, along with other relevant factors, in connection with their ongoing evaluation of our compensation program.

|

| ·

| | Ratification of the appointment of our independent auditors (Proposal 3). The proposal to ratify the Audit Committee’s appointment of BDO USA, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016 requires the affirmative vote of a majority of the outstanding shares of Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote. Abstentions will have the effect of a vote against this proposal.

|

| ·

| | Stockholder proposal regarding simple majority voting (Proposal 4). The stockholder proposal regarding simple majority voting requires the affirmative vote of a majority of the outstanding shares of Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote. Broker non-votes will have no effect on the outcome of this proposal, while abstentions will have the effect of a vote against this proposal. Although this vote is advisory and is non-binding on our Board of Directors, the Board will consider the voting results, along with other relevant factors, in connection with its review of the outcome of the vote on this proposal.

|

All valid proxies received prior to the Annual Meeting will be exercised. All sharesReport. Shares represented by a properly executed proxy will be voted, and where a proxy specifies a stockholder’s choice with respect to any matter to be acted upon, the shares will be voted in accordance with that specification. If you are a stockholder of record and sign and return your proxy card or vote electronically without making any specific selections, then your shares will be voted in accordance with the recommendations ofinstructions provided by the proxy holders on all matters presentedstockholder. This summary highlights information contained elsewhere in this Proxy Statement; however, it does not contain all of the information you should consider. You should read the entire Proxy Statement and as the proxy holders may determine in their discretion regarding any other matters properly presented for a vote at the Annual Meeting.

How do I vote my shares?

You can either attendbefore casting your vote.

Additional information, including “FREQUENTLY ASKED QUESTIONS” about this Proxy Statement, the Annual Meeting, and votevoting can be found on page 81.

| | |

| 2021 Performance Highlights |

For more information on our 2021 results and other related financial measures, we refer you to our 2021 Annual Report.

CAUTIONARY INFORMATION REGARDING FORWARD-LOOKING STATEMENTS AND WEBSITE REFERENCES

This Proxy Statement contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including as they relate to our expectations, goals, or plans related to corporate responsibility, sustainability and environmental matters, employees, policy, business, procurement and other risks and opportunities, as do other materials or oral statements we release to the public. Forward-looking statements are neither historical facts nor assurances of future performance, but instead are based only on our current beliefs, expectations, and assumptions regarding the future of our business, plans and strategies, projections, anticipated events and trends, the economy, and other future conditions, as of the date on which this report is filed, and these are subject to change, including the standards for measuring progress that are still in persondevelopment. All statements other than statements of historical or givecurrent facts, including statements regarding our strategy, our operational objectives, and our environmental and social plans and goals, made in this document are forward-looking and aspirational, and are not guarantees or promises such expectations, plans, or goals will be met. Forward-looking statements often, but do not always, contain words such as “expect,” “anticipate,” “aim to,” “designed to,” “commit,” “intend,” “plan,” “believe,” “goal,” “target,” “future,” “assume,” “estimate,” “seek,” “project,” “may,” “can,” “could,” “should” or “will,” and other words and terms of similar meaning.

Forward-looking statements are subject to inherent risks, uncertainties, and changes in circumstances that are often difficult to predict and many of which are beyond our control. Our actual results and financial condition may differ materially from those indicated in forward-looking statements, and important factors that could cause them to do so include, but are not limited to, the risks and uncertainties described in our 2021Annual Report on Form 10-K.

We undertake no obligation to update or publicly revise any forward-looking statements as a proxyresult of new information, future developments or otherwise. All subsequent written or oral forward-looking statements attributable to be voted atus, or persons acting on our behalf, are expressly qualified in their entirety by this section. You are advised, however, to consult any further disclosures we make on related subjects in our reports and other filings with the Securities and Exchange Commission (the “SEC”). Website references throughout this document are provided for convenience only, and the content on the referenced websites is not incorporated by reference into this document.

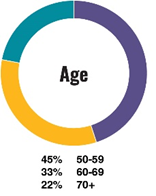

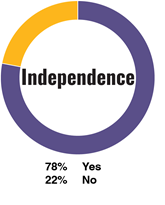

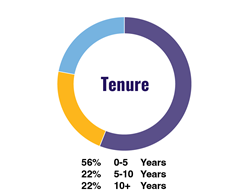

Corporate Governance Highlights

Our Board has developed strong corporate governance practices to promote long-term value creation, transparency, and accountability to our stockholders. Highlights of our corporate governance policies and structure following the Annual Meeting. A proxy may be given in one of the following three ways:Meeting include:

| ·

| | electronically

| | | | | |

| |

| WHAT WE DO |

| | •78% Independent Directors - 7 of 9 •33% Female Directors - 3 of 9 (Including Chair of Nom Gov Committee) •"Plurality-Plus" Voting for Directors (mandatory resignation policy for nominees who fail to receive an affirmative majority of votes cast) •Limitations on Outside Public Company Board Service •Lead Independent Director •Separate Chairman of the Board and Chief Executive Officer •Entirely Independent Committees •Audit Committee Financial Experts - 5 of 7 •Annual Board and Committee Self-Evaluations •Systemic Risk Oversight by using the Internet;Board and Committees •Environmental, Social, and Governance (“ESG”) Oversight by Board and Committees •Cybersecurity and Information Technology Oversight by Board and Committees •Regular Executive Sessions of Independent Directors •Investor Outreach Program •Equity Ownership Policy with required holdings for Directors and Executives •Cash and Equity Compensation Clawback Policy •Annual Say on Pay Advisory Vote •"Double-Trigger" for Change in Control Severance Payments •Ongoing Board Refreshment Planning •Executive Succession Planning Process •Comprehensive Code of Business Conduct, Standards and Ethics; Supplier Code of Conduct; and Corporate Governance Guidelines •Compliance Hotline |

| ·

| | | | | | | |

| |

WHAT WE DON’T DO

|

| | •Poison Pill •Pledging of Our Securities •Hedging of Our Securities •Repricing of Stock Options without Stockholder Approval •Cash Buyouts of Underwater Stock Options without Stockholder Approval •Excess Perquisites |

| | | | | |

Environmental Sustainability |

| Our industry. Our communities. Our world. We focus on the responsibility we have as a financial technology provider and gaming equipment manufacturer to respect our environment. To support our efforts we have a number of Company-wide programs in place to protect the environment, including: Reducing Resource Consumption and Waste, Recycling and Parts Refurbishment, and Lowering Carbon Emissions. |

Reducing Resource Consumption and Waste | Our ongoing initiatives include consolidating facilities and our physical footprint, as well as supporting and encouraging remote work for certain positions. We know that these efforts are beneficial to our sustainability efforts, including reduction of our energy, water, and paper consumption. We strive to reduce overall water and electricity usage in our existing domestic offices and production facilities by installing LED lighting, motion-activated lights and faucets, low-flow toilets, and water filtration systems. We have implemented recording and reporting protocols at our domestic corporate and administrative offices and production locations to monitor our environmental impact at those locations, supporting our progress towards setting long-term sustainability targets.

|

| |

Recycling and Parts

Refurbishment | We currently have recycling partners in place for industrial material used in the assembly of our products, including paper, cardboard, certain electronic components, and certain metals. We also work with our suppliers and shippers to repurpose wooden pallets and packaging materials used in shipping our products. In our Games segment, we redeploy approximately 40% of our gaming devices as well as repurposing individual component parts to the extent possible. In our FinTech segment, servers and network equipment, including end-of-life hardware for our Automated Teller Machines (“ATMs”) and fully integrated kiosks, are also recycled. We also have recycling partners in place for copy paper recycling at over 80% of our domestic administrative offices and production facilities. In 2021, we recycled approximately 53,300 pounds of paper from our primary Las Vegas, Nevada and Austin, Texas facilities.

|

| |

Lowering Carbon Emissions | Everi’s commitment to a reduced carbon footprint and preservation of our precious water supply includes using 100% renewable energy to host our data at SWITCH facilities. This 100% green energy supply is generated by Nevada solar farms and Western Electricity Coordinating Council hydroelectric plants.

Commencing in Q2 2021, the telephoneCompany committed to the leasing or purchase of hybrid or electric vehicles for its field service personnel, and will retire and replace its existing inventory with such vehicles over a period of time. |

| | | | | | | | | | | |

| Social Responsibility |

| We are committed to contributing positively to our communities and to creating and sustaining a positive work environment and corporate culture that fosters employee engagement, health, safety, well-being, diversity and inclusion and equal opportunity. We progress towards this through a focus on recruitment and retention of employees with skills. |

Corporate Culture | We foster an inclusive culture among our employees so that the WHY we work at Everi reflects our shared commitment to positively impact our employees, partners, customers and their guests, stockholders, communities, and the environment. To build this culture we have invested in programs and implemented standards to promote the community, responsible gaming efforts, ethical business conduct, comprehensive human capital management (diversity and inclusion, talent attraction, retention and development, and rewards) sustainability, giving and volunteerism. We recently created an internal ESG Committee, led by callingour CEO and General Counsel and comprised of employees of the Company across business areas and various professional levels, which functions as a toll‑free number; orcentral task force for our ESG initiatives. Our ESG Committee meets on at least a monthly basis to discuss the Company’s ESG framework, identify action items to pursue, review progress with our ESG efforts, discuss recent developments and trends, and to collect feedback from members on potential additional initiatives, activities, and next steps. Our Board receives quarterly reports at its Board meetings on ESG developments, trends, and the Company’s ESG framework, initiatives, and activities and holds discussions with senior management regarding the efficacy of our efforts. We believe that these efforts will contribute to our long-term business success, empower our team members, and support our Core Company Values: Collaboration, Integrity, Inclusion, Excellence, and Fun. |

| |

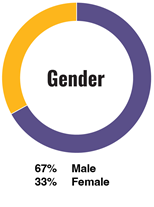

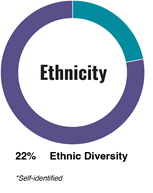

Diversity and Inclusion | We embrace and live by one of our key Company values: Inclusion. We recognize that we can be at our best only when we embrace and reflect the diversity of not only our employees, but the customers and communities that we serve. We believe diverse backgrounds, perspectives, and talents will enable us to continue to be successful and drive shareholder value. The efforts to support diversity in leadership at Everi start with the Board. Currently 33% of Everi’s Board members are female and 22% are ethnically diverse. Our most recently elected female Board member, Secil Tabli Watson, is a member of Extraordinary Women on Boards, a private membership community for highly accomplished women actively serving on corporate boards. Eileen Raney, Chair of our Nom Gov Committee, is certified as a National Association of Corporate Directors Board Leadership Fellow, and has held this honor since 2018. In 2021, we invested further in this commitment by hiring a new Senior Vice President to oversee Diversity, Inclusion and Talent Management, focusing on the continued work to build inclusion for our employees, drive our corporate culture, and to seek out and welcome new talent. Everi’s Women’s Leadership Initiative (“WLI”): Everi continues to work to advance gender diversity, create new opportunities, and increase the representation of women in our workforce through the WLI. To date, over 165 employees have participated in the training, educational, and networking opportunities offered, with the class of 2022 being the most inclusive to date, consisting of 55 members across North America, including fully remote team members. Focusing on the importance of training, Company-wide diversity and inclusion training is mandatory for employees and is intended to cultivate an inclusive, engaging, and respectful workplace, and includes separate training on the impact of bias in the selection and hiring processes that is mandatory for hiring managers. Further, in 2021, our executive leadership team set the example for the Company by participating in separate inclusive leadership training. Our total combined hours for mandatory diversity and inclusion training were approximately 2,500 hours for 2021, including supplemental training for hiring managers and the executive leadership team.

|

| |

Diversity in Hiring | Recently, the Company entered into a strategic agreement with the Partnership for Youth Success® Program of the U.S. Army. Through this program, the Company has the opportunity to post open positions for consideration by service women and service men upon their transition from their military service. Upon viewing a position of interest that is in line with their background and expertise, soldiers then reach out to the Company to seek an interview. Qualified candidates will be guaranteed an interview and they will be considered for employment.

|

| |

| | | | | | | | | | | |

| Social Responsibility - Continued |

Diversity and Heritage

Celebrations | As part of the celebration of Women’s History Month in March, the Company hosted for its employees “A Seat at the Table: A Chat with Everi Board Members,” with guest speakers Eileen Raney, Maureen Mullarkey, and Secil Tabli Watson, to share some of their personal stories as well as insights and advice they have learned throughout their journeys. |

| |

Employee Engagement, Satisfaction & Awards | Aligning with our values of Inclusion and Collaboration, we engage with our employees on a regular basis, seeking feedback about their experience at Everi. Through an annual employee engagement survey for the Top Workplaces program, our employees shared their positive feedback and belief in Everi. Looking at the results of this survey, 83% of employees at Everi feel that their manager cares about their concerns, ranking the Company in the Top 12% of all participating companies in the entertainment, hospitality and casino gaming industry. The Company was also ranked in the top 6% of all participating entertainment, hospitality and casino gaming companies because so many of our employees agreed that they have the work-life flexibility they need. TOP WORKPLACES AWARDS: In 2021, Everi received four separate Top Workplaces Awards in the United States: “Nevada Top Workplaces 2021”; “Greater Austin Top Workplaces 2021” (Texas); a national Culture Excellence Award for “Direction” reflecting our employees’ strong belief in our future and our strategy; as well as a national Culture Excellence Award for “Remote Work” for creating a desirable culture in a remote work environment. In India, our operations received a certification as a Great Place to Work® in November 2021, based on the survey feedback of our India team. In early 2022, the United States operations received yet another award: the highest accolade from the Top Workplaces program as a “Top Workplaces 2022” on a national level. |

| |

Community Engagement,

Giving, and Volunteerism | Community Engagement: Throughout the year the Company focuses on different heritage celebrations, holidays, and commemorations. We connect with our employees to build awareness through educational webinars and guest lecturers, and we engage with the communities in which we operate by donating to various support organizations. Charitable Contributions: In 2021, the Company made charitable contributions across many deserving organizations, showcased on our Corporate Social Responsibility webpage at: https://www.everi.com/about-us/corporate-social-responsibility/. |

| |

Responsible Gaming | Over the years, the Company has worked with dozens of leading responsible gaming associations across the globe to develop a set of comprehensive tools to help prevent problem gamblers from obtaining funds in a casino. The Company's initiatives and controlled solutions enable casinos to enhance their promotion of responsible gaming while helping them comply with local laws, customs, and culture in the prevention of problem gambling. Everi’s Personal Self Transaction Exclusion Program (“STeP”) is a way for patrons to block access to cash across the Company’s national network of ATMs, financial access kiosks, and booth services. Our CashClub Wallet™ also includes a self-imposed velocity and transaction limits as a supplement to our existing STeP program. |

| | | | | | | | |

| Social Responsibility - Continued |

Benefit Enhancements | As a result of input received from Company employees through our 2021 annual benefits survey, we implemented enhanced benefits effective January 1, 2022, including: •For the seventh year in a row, no increases to employee premiums (contributions) to medical, dental, and vision benefits •An increase in the 401(k) match provided by the Company •Lower in-network deductibles across health plans •Addition of a new mental health and wellness program with easy access to preventative care, self-care and professional services, including virtual coaching sessions •Expanded parental leave for birth and non-birth parents •Expanded gym reimbursement

|

| |

Human Capital | In addition to our Corporate Culture initiatives, Everi implemented initiatives to support career growth, training and development opportunities, new talent acquisition and diverse recruiting, and actively solicited employee feedback. For additional information on Everi’s Human Capital initiatives and programs, please refer to page 31 herein, and page 14 of the Company’s 2021 Annual Report. |

For additional information on Everi’s Environmental Sustainability and Social Responsibility initiatives and programs, please refer to page 28 herein, page 14 of the Company’s 2021 Annual Report, and the Company’s Corporate Social Responsibility webpage at: https://www.everi.com/about-us/corporate-social-responsibility/.

| | |

PROPOSAL 1 ELECTION OF TWO CLASS II DIRECTORS (Item No. 1 on the Proxy Card) THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE ELECTION TO THE BOARD OF THE NOMINEES NAMED BELOW. |

| ·

| | by mailing the enclosed proxy card.

|

The Internet and telephone voting procedures have been set up for your convenience and are designed to authenticate stockholders’ identities, to allow stockholders to provide their voting instructions, and to confirm that their instructions have been recorded properly. The Company believes the procedures that have been put in place are consistent with the requirements of applicable law.

Specific instructions for stockholders who wish to use the Internet or telephone voting procedures are set forth on the enclosed proxy card. If your shares are held in street name by a bank, brokerage firm, trustee or other holder of record, you will receive instructions from the record holder that you must follow in order to have your shares voted.

Who will tabulate the votes?

An automated system administered by Broadridge Financial Solutions, Inc. (“Broadridge”) will tabulate votes cast by proxy at the Annual Meeting and a representative of Broadridge will tabulate votes cast in person at the Annual Meeting.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties, except as necessary to meet applicable legal requirements or to allow for the tabulation and/or certification of the vote.

Can I change my vote after submitting my proxy?

You can change your vote at any time before your proxy is exercised at the Annual Meeting. You may do so in one of the following four ways:

| ·

| | submitting another proxy card bearing a later date;

Qualifications of Our Class II Director Nominees: |

| ·

| | sending a written notice revoking your proxy to the Corporate Secretary of the Company at 7250 South Tenaya Way, Suite 100, Las Vegas, Nevada 89113;

|

þ Mr. Judge is independent and has extensive experience in the financial services and payments industries. | ·

| | submitting new voting instructions via telephone or the Internet (if initially able to vote in that manner); or

|

| ·

| | attending the Annual Meeting and voting in person.

|

If you hold your shares in “street name” throughþ Mr. Rumbolz is a bank, broker, trustee or other holder of recordnon-independent Director and you have instructedis the bank, brokerage firm, trustee or other holder of record to vote your shares, you must follow the directions received from the holder of record to change those instructions. Please refer to the information forwarded by your bank, brokerage firm, trustee or other holder of record for procedures on revoking or changing your proxy.

Who is paying for this proxy solicitation?

This proxy solicitation is being made by the Company. The Company will bear the cost of soliciting proxies, including the cost of preparing, assembling, printing and mailing this Proxy Statement. The Company also will reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation materials to such beneficial owners. In addition, proxies may be solicited by certainExecutive Chairman of the Company’s directors, officersBoard effective April 1, 2022.

þ Messrs. Judge and regular employees, either personally, by telephone, facsimile or e‑mail. NoneRumbolz, respectively, have 15+ and 11+ years of such persons will receive any additional compensation for their services.How can I find out the voting results?

service on our Board.

þThe Company will report the voting results in a Current Report on Form 8‑K to be filed within four business days after the end of the Annual Meeting.How do I receive electronic access to proxy materials for future annual meetings?

Stockholders can elect to view future proxy statementstwo nominees are highly qualified, experienced, and annual reports over the Internet instead of receiving paper copies, which results in cost savings for the Company. If you are a stockholder of record and would like to receive future proxy materials electronically, you can elect this option by following the instructions provided when you vote your proxy over the Internet at www.proxyvote.com. If you choose to view future proxy statements and annual reports over the Internet, you will receive an e‑mail notification next year with instructions containing the Internet address of those materials. Your choice to view future proxy statements and annual reports over the Internet will remain in effect until you contact either your broker or the Company to rescind your instructions. You do not have to elect Internet access each year.

actively engaged individuals. | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Director Since | | Principal (or Most Recent) Occupation | | Current Committees |

| Geoffrey P. Judge | | 68 | | 2006 | | Former partner at iNovia Capital, a manager of early-stage venture capital funds, from 2010 to 2016, and served as a Member of the Board of iNovia portfolio companies from September 2010 until April 2021. Active private equity investor since 2002. | | •Audit Committee •Compensation Committee (Chair) •Nominating and Governance Committee (“Nom Gov Committee” or “Nom Gov”) |

| Michael D. Rumbolz | | 68 | | 2010 | | Executive Chairman of the Board of the Company effective as of April 1, 2022, and member of the Board of the Company since 2010. | | |

If your shares of Common Stock are registered in the name of a brokerage firm, you still may be eligible to vote your shares of Common Stock electronically over the Internet. A large number of brokerage firms are participating in the Broadridge online program, which provides eligible stockholders who receive a paper copy of this Proxy Statement the opportunity to vote via the Internet. If your brokerage firm is participating in Broadridge’s program, your proxy card will provide instructions for voting online. If your proxy card does not reference Internet information, please complete and return your proxy card.

How can I avoid having duplicate copies of the proxy statements sent to my household?

The Securities and Exchange Commission (“SEC”) has adopted rules that permit companies and intermediaries, such as brokers, to satisfy delivery requirements for annual reports and proxy statements with respect to two or more stockholders sharing the same address by delivering a single annual report or proxy statement addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially provides extra convenience for stockholders and cost savings for companies. Brokers with account holders who are stockholders of the Company may be householding the Company’s proxy materials. Once you have received notice from your broker that it will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate annual report or proxy statement or if you are receiving multiple copies thereof and wish to receive only one, please notify your broker or notify the Company by sending a written request to the Company’s Investor Relations department at 7250 South Tenaya Way, Suite 100, Las Vegas, Nevada 89113, telephone number (702) 855‑3000.

When are stockholder proposals due for next year’s annual meeting?

Stockholder proposals may be included in our proxy materials for an annual meeting so long as they are provided to us on a timely basis and satisfy certain other conditions established by the SEC, including specifically under Rule 14a‑8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). To be timely, a proposal to be included in our proxy statement must be received at our principal executive offices, addressed to our Secretary of the Company, not less than 120 calendar days before the date of our proxy statement released to stockholders in connection with the previous year’s annual meeting. Accordingly, for a stockholder proposal to be included in our proxy materials for our 2017 annual meeting of stockholders, the proposal must be received at our principal executive offices, addressed to our Secretary of the Company, not later than the close of business on December 26, 2016.

Subject to certain exceptions, stockholder business that is not intended for inclusion in our proxy materials may be brought before an annual meeting so long as notice of the proposal as specified by, and subject to the conditions set forth in, our Second Amended and Restated Bylaws, is received at our principal executive officers, addressed to our Secretary of the Company, not earlier than the close of business on the 120th day, nor later than the close of business on the 90th day, prior to the first anniversary of the date of the preceding year’s annual meeting. For our 2017 annual meeting of stockholders, proper notice of business that is not intended for inclusion in our proxy statement must be received no earlier than the close of business on January 23, 2017, nor later than the close of business on February 22, 2017.

A stockholder’s notice to the Secretary must set forth as to each matter the stockholder proposes to bring before the annual meeting: (i) as to each person whom the stockholder proposes to nominate for election or reelection as a director all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required, in each case pursuant to Regulation 14A under the Exchange Act and Rule 14a‑4(d) thereunder (including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected); (ii) as to any other business that the stockholder proposes to bring before the meeting, a brief description of the business desired to be brought before the meeting, the reasons for conducting such business at the meeting and any material interest in such business of such stockholder and the beneficial owner, if any, on whose behalf the proposal is made; and (iii) as to the stockholder giving the notice and the beneficial owner, if any, on whose behalf the nomination or proposal is made (a) the name and address of such stockholder, as they appear on the Company’s books, and of such beneficial owner, (b) the class and number of shares of the Company which are owned beneficially and of record by such stockholder and such beneficial owner, and (c) whether either such stockholder or beneficial owner intends to deliver a proxy statement and form of proxy to holders of, in the case of the proposal, at least the percentage of the Company’s voting shares required under applicable law to carry the proposal or, in the case of a nomination or nominations, a sufficient number of holders of the Company’s voting shares to elect such nominee or nominees.

PROPOSAL 1

ELECTION OF CLASS II DIRECTORS

Our Amended and Restated Certificate of Incorporation as amended, provides that the number of directors that shall constitute the Board shall be exclusively fixed by resolutions adopted by a majority of the authorized number of directors constituting the Board. The Company’s Second Amended and Restated Bylawsbylaws state that the authorized number of directors of the Company shall be fixed in accordance with the Company’s certificateCertificate of incorporation as then in effect. The authorized number of directorsIncorporation. Effective January 21, 2022, the Board, acting upon the recommendation of the Company is currently set at seven, and there is one position onNom Gov Committee, increased the size of the Board that is currently vacant. The Company’s Amended and Restatedto ten members. Our Certificate of Incorporation as amended, and Second Amended and Restated Bylawsbylaws provide that the Board shall be divided into three classes constituting the entire Board. The members of each class of directors serve staggered three‑yearthree-year terms. Proxies cannot be voted for a greater number of persons than the number of nominees named in this Proxy Statement. Currently,As of the filing of the Proxy Statement, the Board is composed of the following sixten members:

| | | | | | | | | | | |

Class | Directors | Directors

Term Commencement | | Term Expiration |

I | | E. Miles Kilburn and

Eileen F. Raney, Atul Bali(1), Paul W. Finch, Jr.(2), and Randy L. Taylor(3) | | 20182021 Annual Meeting of Stockholders

| 2024 Annual Meeting of Stockholders |

II | | Geoff

Geoffrey P. Judge, Michael D. Rumbolz, and Ronald V. Congemi(4) | | 20162019 Annual Meeting of Stockholders

|

III

| | Fred C. Enlow

| | 20172022 Annual Meeting of Stockholders

|

| III | Linster W. Fox, Maureen T. Mullarkey, and Secil Tabli Watson(5) | 2020 Annual Meeting of Stockholders | 2023 Annual Meeting of Stockholders |

___________________

(1)Mr. Bali’s term of office as Lead Independent Director will begin on May 18, 2022.

(2)Mr. Finch’s term of office began effective as of February 1, 2022.

(3)Mr. Taylor’s term of office began effective as of April 1, 2022.

(4)Mr. Congemi will retire and will not stand for re-election at the Company’s 2022 Annual Meeting.

(5)Ms. Watson’s term of office began effective as of February 1, 2022.

On January 21, 2022, Ronald V. Congemi, a member of the Board since February 2013, informed the Company that he will retire from the Board and will not stand for re-election at the Company’s 2022 Annual Meeting. Therefore, Mr. Congemi’s last day of service as Lead Independent Director of the Board, and member of the Audit Committee, Compensation Committee, and Nom Gov Committee of the Board, will be May 18, 2022. The Board named Atul Bali, an independent member of the Board since November 2019, as Lead Independent Director, effective upon Mr. Congemi’s last day of service. In light of Mr. Congemi’s retirement, the size of the Board will be reduced to nine members and the number of Class II Directors will be reduced to two, effective as of the 2022 Annual Meeting.

Upon the recommendation of the

Nominating and Corporate GovernanceNom Gov Committee of the Board, the Board has nominated

Messrs.Geoffrey P. Judge

and Michael D. Rumbolz,

and Congemi, who are each currently acurrent Class II

DirectorDirectors of the Company, for

reelectionelection as

a Class II

DirectorDirectors of the

Company, toCompany. If elected, each will serve a

three‑yearthree-year term until the

2019 annual meeting2025 Annual Meeting of

stockholdersStockholders and until

a respectivehis successor is duly elected and qualified or until his earlier resignation or removal.

Each of Messrs. Judge

Rumbolz and

CongemiRumbolz have consented, if

reelectedelected as

a Class II

DirectorDirectors of the Company, to serve until

his term expires.their respective terms expire. The Board believes that

each of Messrs. Judge

Rumbolz and

CongemiRumbolz will serve if elected, but if

one of thema nominee should become unavailable to serve as a director, and if the Board designates a substitute nominee, the person or persons named as proxy in the enclosed form of proxy may vote for a substitute nominee recommended by the

Nominating and Corporate GovernanceNom Gov Committee and approved by the Board.